nj property tax relief for seniors

Senior Freeze Property Tax Reimbursement Program. 150000 or less for homeowners aged 65 or over blind or disabled.

Property Tax How To Calculate Local Considerations

For information call 800-882-6597 or to visit the NJ Division of Taxation.

. Ad No Money To Pay IRS Back Tax. Forms are sent out by the State in late Februaryearly March. The Property Tax Reimbursement Program reimburses eligible senior citizens and disabled persons for property tax increases.

Politics Government 2B In Proposed NJ Tax Relief Would Help 55M People Gov. As an alternative taxpayers can file their returns online. Request for a Letter of Property Tax Relief Ineligibility Out-of-State Residents.

Average bill more than 9000. This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. The Senior Freeze program which reimburses eligible seniors and disabled residents for increases in their property taxes or mobile home fees is still available.

The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes. 75000 or less for homeowners under the age of 65 and not blind or disabled. Finally there is a Property Tax DeductionCredit to homeowners of either up to 15000 of property taxes paid or a 50 refundable credit refundable meaning that even if.

The Business Tax telephone filing system is experiencing issues with the 609-341-4800 filing number. But the deadline to. NJ property taxes climbed again in 2020.

The amount of the reimbursement is the difference. Property Tax Relief Programs. Meet the income requirements.

Ad No Money To Pay IRS Back Tax. Property Taxes Site Fees. And for the senior-freeze program Treasury officials have estimated the FY2022 budget will fund.

Nearly 160000 homeowners received senior-freeze reimbursements during the 2021 fiscal year ranging on average from 196 for new recipients to 1348 for longer-term. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. The 2020 property taxes due on your home must have been paid by June 1 2021 and the 2021 property taxes must be paid by June 1 2022.

It was founded in 2000 and has since become a participant in the American. About the Company Property Tax Relief For Nj Seniors CuraDebt is a debt relief company from Hollywood Florida. The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence main.

The program is open to homeowners who are older than 65 blind or disabled and earn less than 150000 annually or homeowners under age 65 who are not blind or disabled. Applications for the homeowner benefit are not available on this site for printing. If you meet certain requirements you may have the right to claim a.

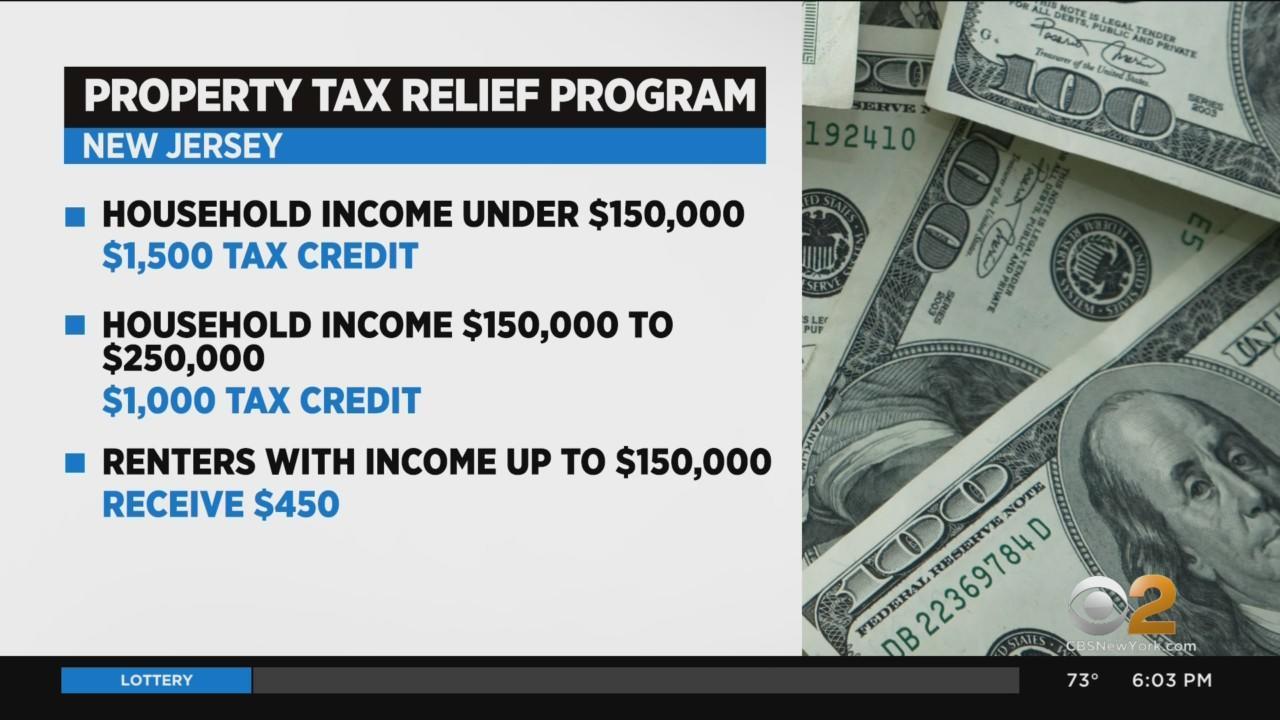

Murphy Says Nearly 1M homeowners in New Jersey would save 1500 per year on property taxes under the. Property Tax Relief Forms.

Just A Reminder It Is That Time Of Year To File Your Homestead Exemption Here Is The Information Hope You Have A G Selling House Just A Reminder Homesteading

Get Download Property Tax Appeals Property Tax Reduction Bonus Http Ino Marketing Checklist Affiliate Marketing Passive Income Affiliate Marketing 101

Nj Property Tax Relief Program Updates Access Wealth

Real Property Tax Howard County

Murphy Announces Details Of Property Tax Relief Program Whyy

Deducting Property Taxes H R Block

Property Taxes Property Tax Analysis Tax Foundation

Printform Finance Incoming Call Screenshot Property Tax

Property Taxes By State Embrace Higher Property Taxes

Murphy Signs 50 6 Billion Budget With Property Tax Relief

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Florida Property Tax H R Block

2022 Property Taxes By State Report Propertyshark

Documentation For Loan Against Property What You Need To Know Property Tax Tax Debt Relief Loan

Property Taxes How Much Are They In Different States Across The Us

Gov Phil Murphy Announces Expansion Of Anchor Property Tax Relief In New Jersey Cbs New York

Property Taxes Property Tax Analysis Tax Foundation

![]()

2021 Senior Freeze Program Disabled Person Property Tax Reimbursement Filing Deadline October 31 2022 Updated 06 28 2022 Township Of Little Falls

New Jersey Has The Highest Effective Rate On Owner Occupied Property At 2 21 Percent Followed Closely By Illinois 2 05 Percent And N Property Tax Tax States